Tag

MLB

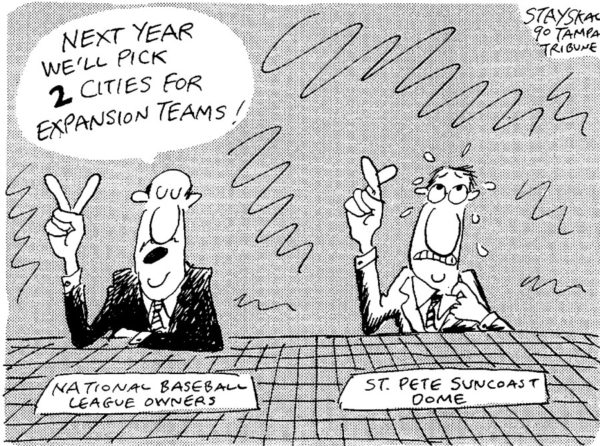

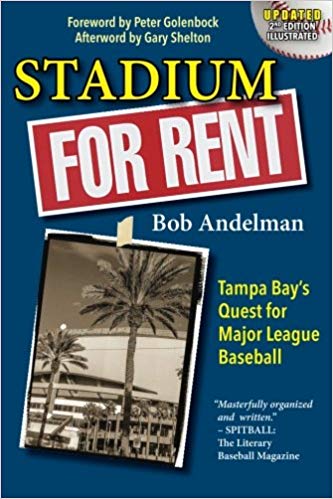

(In 1993, I wrote my first book, Stadium For Rent: Tampa Bay’s Quest for Major League Baseball. In 2015, I updated the backstory of the original Tampa Bay Devil Rays, adding interviews with founder Vincent J. Naimoli and his eventually… Continue Reading →

Wayne Huizenga’s World: Excerpt from “Stadium for Rent: Tampa Bay’s Quest for Major League Baseball”

(AUTHOR’S NOTE: What follows is an excerpt from my very first book “STADIUM FOR RENT: Tampa Bay’s Quest For Major League Baseball,” which was originally published in May 1993 by McFarland & Company. An updated, expanded 2nd edition of the… Continue Reading →

(Lance Ringhaver, a prominent Tampa Bay businessman and once a member of the Tampa Bay Baseball Group, died in a car accident on Tuesday, April 5, 2016. I profiled him in my 1993 book, Stadium For Rent: Tampa Bay’s Quest… Continue Reading →

By Bob Andelman Maddux Business Report Cover Story January/February 2006 There was a day last summer when Stuart Sternberg knew, without question, that he was playing in an entirely different league. Being a Wall Street whiz kid was cool, but… Continue Reading →