Category

Business

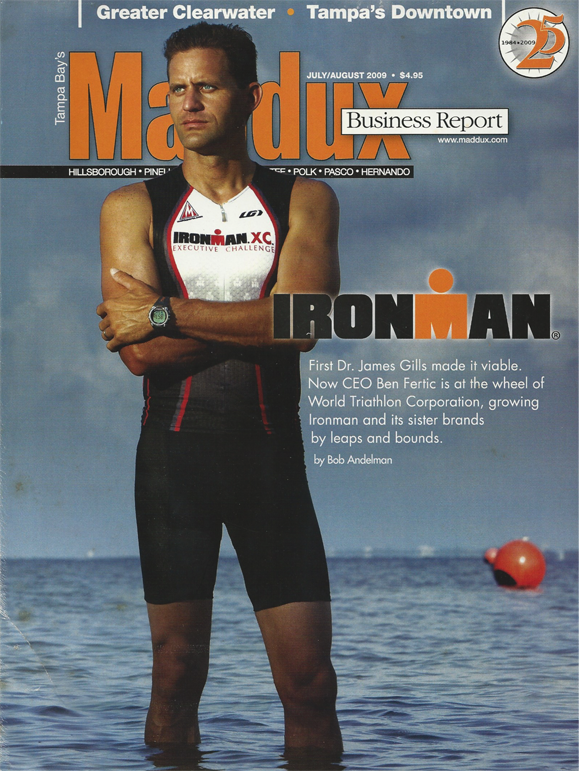

By Bob Andelman May 3, 1985 Frank Zaccaro, new events coordinator for the Florida State Fairgrounds Expo Hall in Tampa, says promoters and patrons can look for the facility to actively pursue major rock music concerts in the immediate future…. Continue Reading →

By Bob Andelman Published June 2008 Hold that thought a moment. Judy Genshaft is collecting hers – well, not her thoughts, but her bulls. Dozens of variations on the University of South Florida mascot that she has collected from all… Continue Reading →

(NOTE–We heard the sad news tonight that legendary Tampa businessman, baker, boxing promoter and entrepreneur Phil Alessi died today, Sunday, May 6, 2018. I dug into my archive for this extensive profile I wrote about Phil, published in Tampa Bay… Continue Reading →

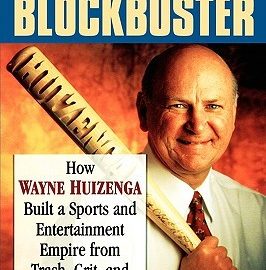

Wayne Huizenga’s World: Excerpt from “Stadium for Rent: Tampa Bay’s Quest for Major League Baseball”

(AUTHOR’S NOTE: What follows is an excerpt from my very first book “STADIUM FOR RENT: Tampa Bay’s Quest For Major League Baseball,” which was originally published in May 1993 by McFarland & Company. An updated, expanded 2nd edition of the… Continue Reading →

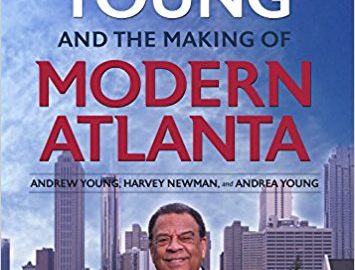

By Bob Andelman (NOTE: This story, written in May, 1990 for the Maddux Report, was the first of three times–so far–that I have had the pleasure to work with legendary civil rights leader Andrew Young. More recently, I have worked… Continue Reading →

By Bob Andelman (Originally written in December 2007; the story is no longer on Biz941’s website archive so I am re-posting it here.) Gemologist Tina Taylor Little discovered up-and-coming jeweler Michael Beaudry at the 1996 New York Jewelry Show, and… Continue Reading →

In November 2017, the Knight Foundation published a collection of 10 profiles of organizations that received Knight News Challenge grants from it over the past decade. I wrote five of these stories, which you can read at the Knight Foundation… Continue Reading →

(Originally published in Tampa Bay Life in 1989) By Bob Andelman “If I had any respect left for Elizabeth Kovachevich, that disappeared when she locked me up. She had a good public image, but I discovered firsthand that she was… Continue Reading →

By Bob Andelman What are the reasons to continue your education in supply-chain management? If you’re the chief executive, what reasons might you have to support employees interested in returning to school? Employees need to know how squeezing night and… Continue Reading →

Story by Bob Andelman Sean Scott is the director of strategic business at Celadon in Indianapolis. He might just be the poster child for the value of a global MBA. “There’s been a lot of stuff that I learned in… Continue Reading →

Another recent story that I wrote for Global Trade Magazine. http://www.globaltrademag.com/executive-education/how-executive-education-propelled-these-careers

… So Your Employee Can Handle Work And School Another recent story that I wrote for Global Trade Magazine. http://www.globaltrademag.com/executive-education/balancing-act

(Lance Ringhaver, a prominent Tampa Bay businessman and once a member of the Tampa Bay Baseball Group, died in a car accident on Tuesday, April 5, 2016. I profiled him in my 1993 book, Stadium For Rent: Tampa Bay’s Quest… Continue Reading →

Sometimes you can find my work — sans byline — in Florida Trend, too. http://www.floridatrend.com/article/19569/georgia-company-florida-success The Party Authority in New Jersey, Pennsylvania, Delaware and Maryland!

Another recent story that I wrote for Global Trade Magazine. http://www.globaltrademag.com/global-trade-daily/commentary/class-action The Party Authority in New Jersey, Pennsylvania, Delaware and Maryland!

My work pops up in all kinds of places these days… such as Global Trade Magazine http://www.globaltrademag.com/global-trade-daily/commentary/fully-covered The Party Authority in New Jersey, Pennsylvania, Delaware and Maryland!

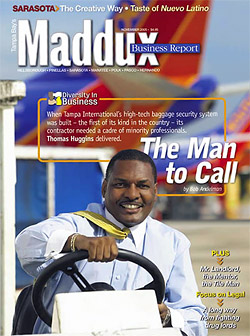

By BOB ANDELMAN Written September 17, 2005 Maddux Business Report Thomas Huggins knows people. Construction people, engineers, environmental consultants, accountants, attorneys and all kinds of professional, small business people. He’s made an entire business of knowing people, knowing people who… Continue Reading →

(This interview with Tampa Mayor Sandy Freedman was recorded in March 1991 for the Maddux Report.) Sandy Freedman’s fingerprints are all over her city. In typical big city fashion, nothing of any significance happens in Tampa these days without the… Continue Reading →

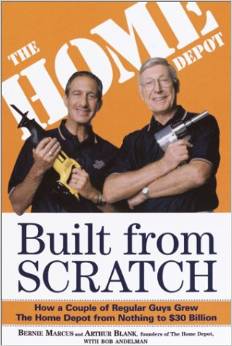

Happy Birthday to one of my most famous collaborators, Bernie Marcus, co-founder of The Home Depot and co-author of ‘Built From Scratch: How a Couple of Regular Guys Grew The Home Depot from Nothing to $30 Billion.” Wish him a… Continue Reading →

(The following story appeared in Tampa Bay Life in 1989.) Rosie Owen just wanted to cash a check. What she got that clear November morning was a few minutes of sheer terror that will last a lifetime. “I had just… Continue Reading →

(This story was written in June 1989. I believe it appeared in Tampa Bay Life later that year. I also believe that some of the original text was lost due to computer incompatibility.) By Bob Andelman It’s 4:30 p.m. and… Continue Reading →

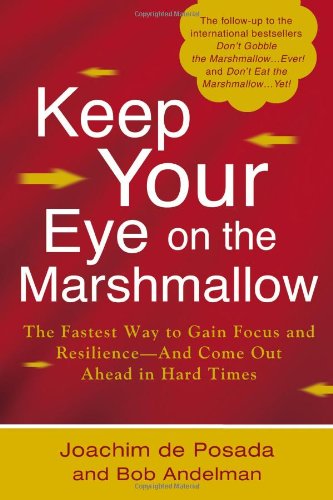

? Cool title, you say, but what’s it about? Here’s the scoop: The follow-up to the international bestsellers Don’t Gobble the Marshmallow…Ever! and Don’t Eat the Marshmallow…Yet! After facing many hardships and challenges, former chauffeur Arthur has come out on… Continue Reading →

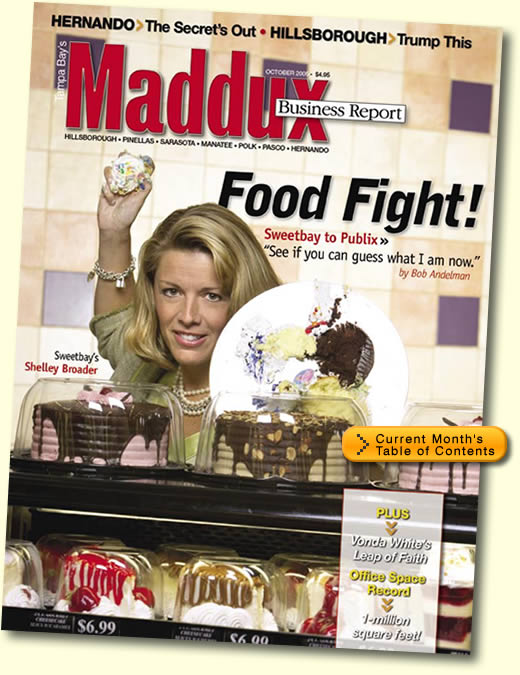

Interview: Shelly Broader, president of Kash n’ Karry/Sweetbay Supermarket. By Bob Andelman (This story originally appeared in the October 2005 issue of the Maddux Business Report, published in St. Petersburg, Florida. The story below is the unedited version and includes… Continue Reading →

(Former Florida Democratic gubernatorial candidate Bill McBride died suddenly today, December 23, 2012. It saddened me greatly as I always enjoyed interviewing him and just being in his company over the years. He and his wife, Alex Sink, were delightful… Continue Reading →

I was nervous when I heard yesterday today that The Sun newspaper in London (circulation: 2.385 million) would be publishing a review of “Fans Not Customers” by Vernon Hill and Bob Andelman today. But I guess I worry too much:… Continue Reading →

A Sarasota company finally recognizes that women drive the car-buying market. By Bob AndelmanBiz941 MagazineOctober 2007 Research shows that women influence buying decisions on more than 85 percent of all new car purchases. So why do the dealerships selling the… Continue Reading →

By Bob AndelmanCorporate Meetings & Incentives MagazineOctober 1, 2007 12:00 PMPicture a dramatic atrium lobby, sleekly adorned with glass, marble, and granite, featuring a cascading water wall that soars 28 feet high and a curving, chrome staircase that leads to… Continue Reading →

By Bob AndelmanMaddux Business Report Cover StoryNovember 2007 Windy Zou Kohl “The Born Diplomat” Windy. It’s a great first name, clearly, but it’s not real. “When I first came to the United States to go to grad school,” says Windy… Continue Reading →

By Bob Andelman Maddux Business Report Cover Story October 2007 Put yourself in Jay Feaster’s shoes. Year in and year out, your team, the Tampa Bay Lightning, is a playoff contender. That would be good enough in most cities, but… Continue Reading →